2024 Mileage Reimbursement Rate Mngl. The allowance for journeys performed in own car/taxi is rs. Business mileage rate for 2024:

21 cents per mile driven for medical or moving. Starting january 1st, 2024, the irs standard mileage rates are….

2024 Mileage Reimbursement Rate Mngl Images References :

Source: bunnieyangelique.pages.dev

Source: bunnieyangelique.pages.dev

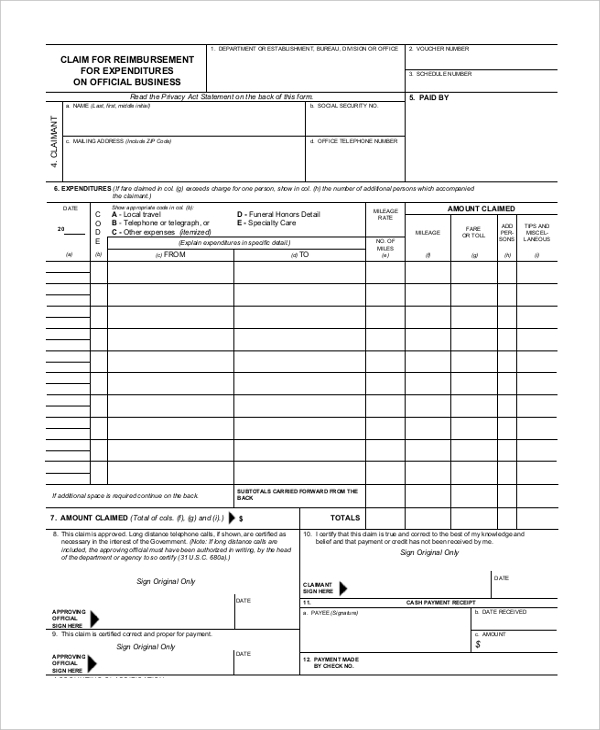

Irs Mileage Rate 2024 Reimbursement Form Shay Yelena, The tier 1 rates reflect an overall.

Source: smallbiztrends.com

Source: smallbiztrends.com

IRS Announces 2024 Mileage Reimbursement Rate, Rates are reviewed on a quarterly basis.

Source: www.travelperk.com

Source: www.travelperk.com

2024 Mileage Reimbursement Calculator with HMRC Rates, Beginning on january 1, 2024, the millage rate for reimbursement for business use will increase to 67 cents per mile.

Source: staceewtrixy.pages.dev

Source: staceewtrixy.pages.dev

Current Gas Mileage Reimbursement 2024 Casey Raeann, To claim this deduction, you must keep a.

Source: www.itilite.com

Source: www.itilite.com

Know More about Mileage Reimbursement 2024 Rates ITILITE, Government utilizes a monthly adjustment in the rate per kilometer paid to employees.

Source: biddyyserene.pages.dev

Source: biddyyserene.pages.dev

Mileage Rate 2024 Reimbursement Netti Gilberte, 65.5 cents per mile), company pay for the tolls, but gas, maintenance, and insurance is on my own.

Source: corporatetaxreturnprep.com

Source: corporatetaxreturnprep.com

2024 Standard Mileage Rates Announced Corporate Tax Return Prep, Beginning on january 1, 2024, the millage rate for reimbursement for business use will increase to 67 cents per mile.

Source: superkilometerfilter.com

Source: superkilometerfilter.com

What Is Car Travel Mileage Reimbursement Rate in 2024? SKF, If you are a sole trader or qualifying close company and use the kilometre rate method to claim business vehicle costs, this new rate applies for the 2024 year, that is, 1.

Source: markham-norton.com

Source: markham-norton.com

Updated Standard Mileage Rates for 2024, Rates are reviewed on a quarterly basis.

Source: cwccareers.in

Source: cwccareers.in

IRS Mileage Reimbursement Rate 2024 Know Rules, Amount & Eligibility, July 1, 2024 the kilometric rates (payable in cents per kilometre) below are payable in canadian funds only.