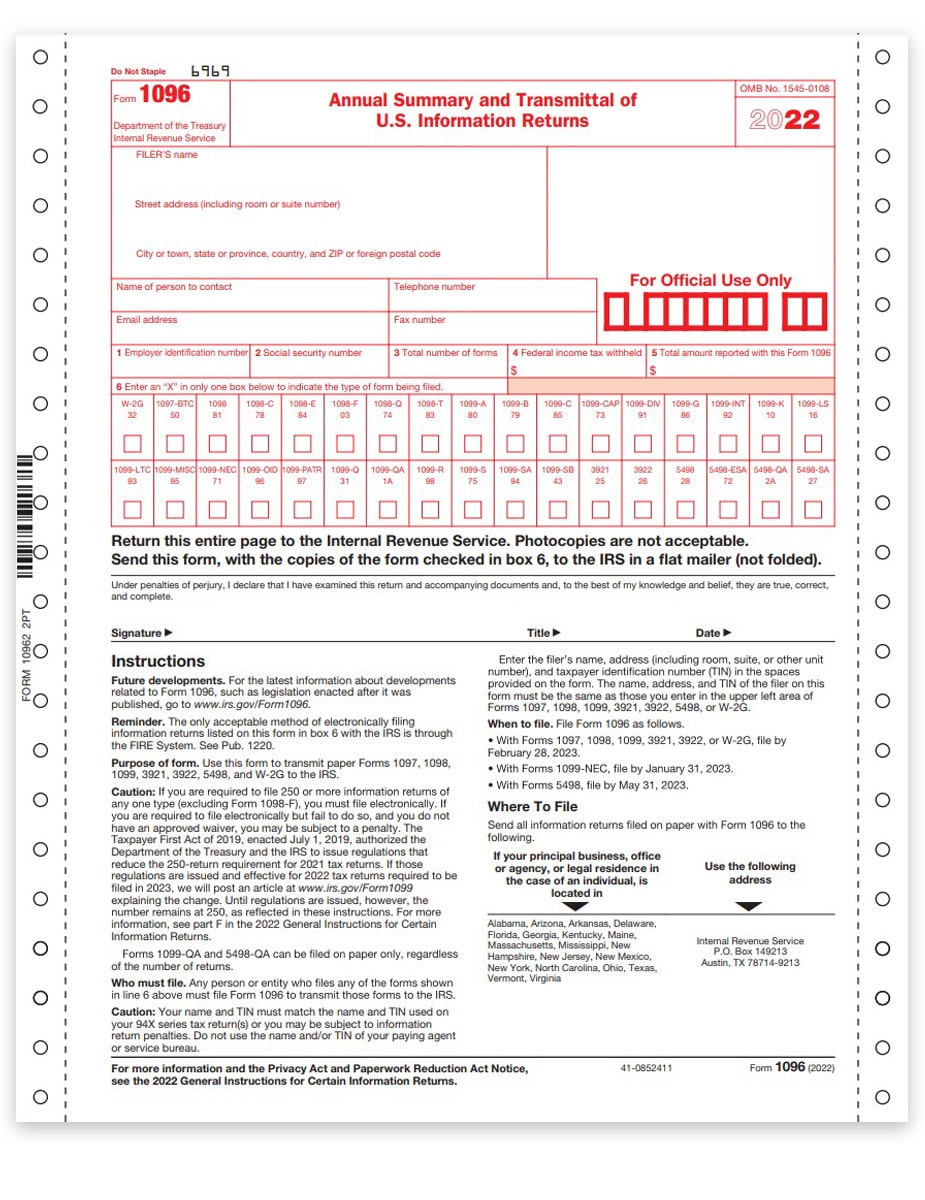

2025 Form 1096 Instructions. Learn about the purpose of this irs tax form, how to file, & who needs to file with block advisors. Additionally, you are required to submit form 1096 alongside form 1099 when forwarding them to the irs.

Form 1096 is due february 28 of the year following the tax year. Information returns, acts as a cover sheet for paper forms of certain information.

Sole Proprietors And All Others Must Enter Their Employer Identification Number (Ein) In Box 1.

Learn about the purpose of this irs tax form, how to file, & who needs to file with block advisors.

Explaining The Basics Of Form 1096.

Form 1096, or the annual summary and transmittal of u.s.

2025 Form 1096 Instructions Images References :

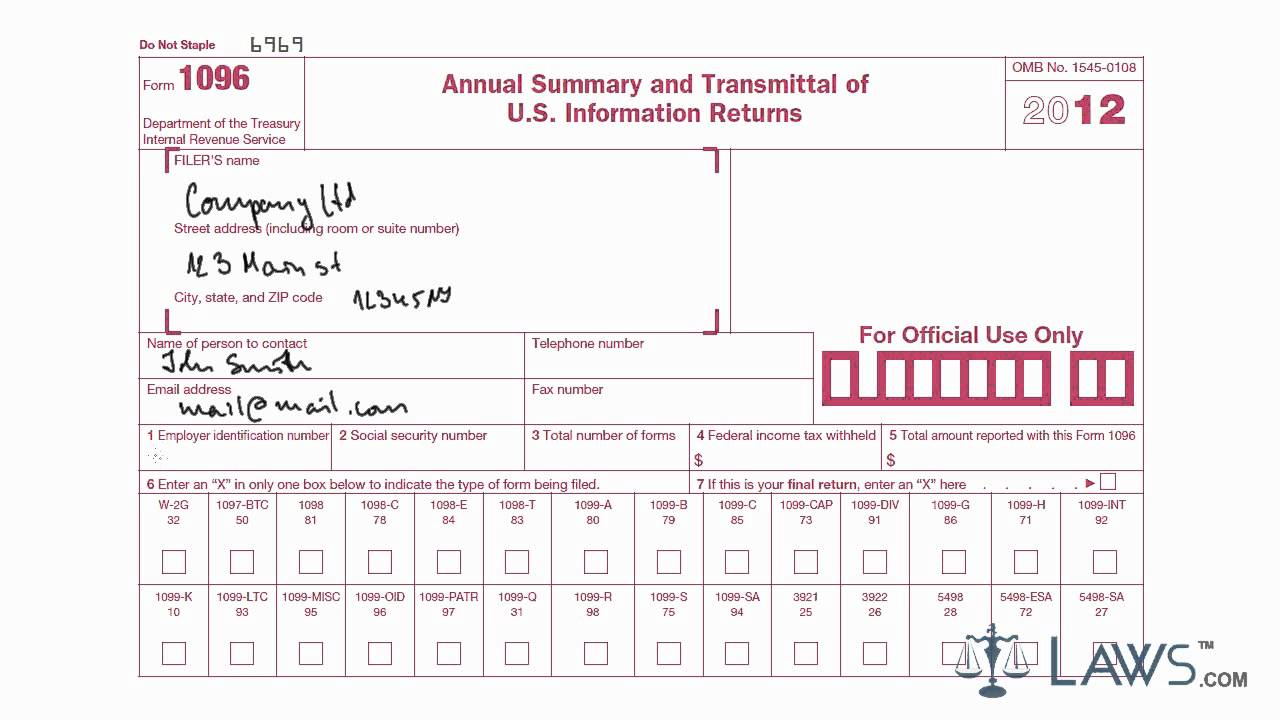

Source: blog.boomtax.com

Source: blog.boomtax.com

Mastering Form 1096 The Essential Guide The Boom Post, Form 1096 is due february 28 of the year following the tax year. Information returns, acts as a cover sheet for paper forms of certain information.

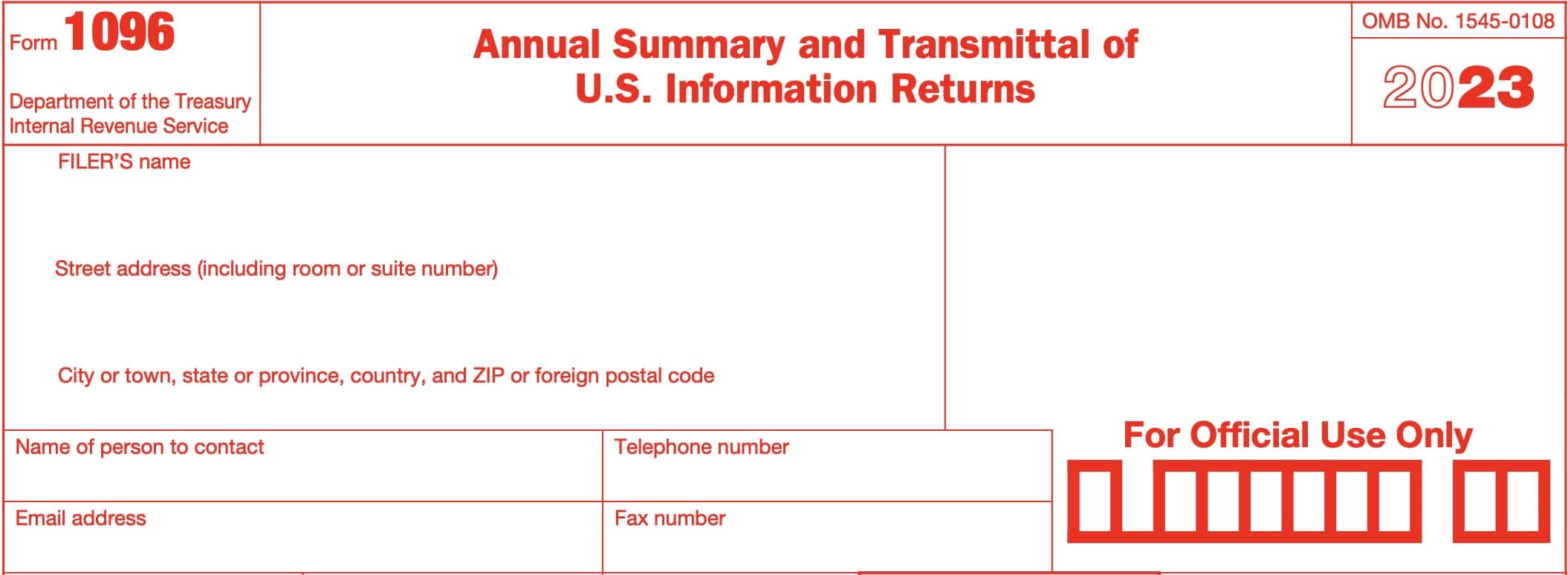

Source: www.pdffiller.com

Source: www.pdffiller.com

Fillable Online IRS Form 1096 Instructions How and When to File It Fax, Form 1096, or the annual summary and transmittal of u.s. Information returns,” is a tax form used by the united states internal revenue service (irs).

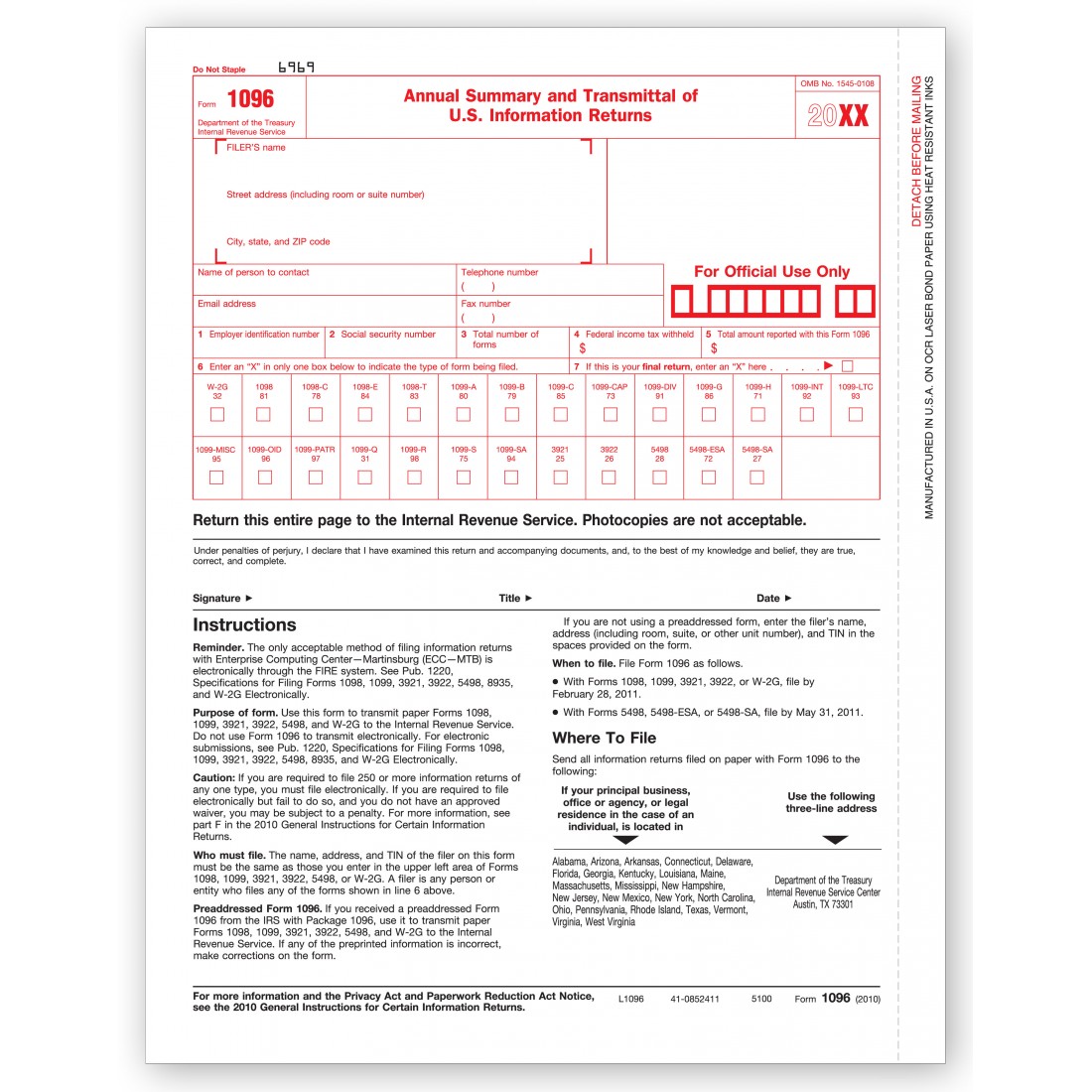

Source: www.youtube.com

Source: www.youtube.com

Learn How to Fill the Form 1096 Annual Summary And Transmittal Of U.S, The box 5 instructions of 2022 instructions for form 1096, annual summary and transmittal of u.s. The organization must use form 1096, annual summary and transmittal of u.s.

Source: www.teachmepersonalfinance.com

Source: www.teachmepersonalfinance.com

IRS Form 1096 Instructions Information Return Transmittal, Irs form 1096, also known as the annual summary and transmittal of u.s. There are, however, some exceptions when form 1096 is due as late as may 31.

Source: templates.rjuuc.edu.np

Source: templates.rjuuc.edu.np

1096 Template For Preprinted Forms, Information returns, regarding the box references for forms 1099. Irs form 1096 is generally used by a business to report payments to freelancers or independent contractors.

/ScreenShot2019-08-22at3.01.28PM-c37afe883a89422880a6d0b275375967.png) Source: printableformsfree.com

Source: printableformsfree.com

Irs Form 1096 Fillable Printable Forms Free Online, Find out more tips to your financial freedom in my book, the common sen. Form 1096, or the annual summary and transmittal of u.s.

Source: www.printez.com

Source: www.printez.com

1096 Forms What it is and How to Prepare it Print EZ, This comprehensive guide will delve into the specifics of irs form. There are, however, some exceptions when form 1096 is due as late as may 31.

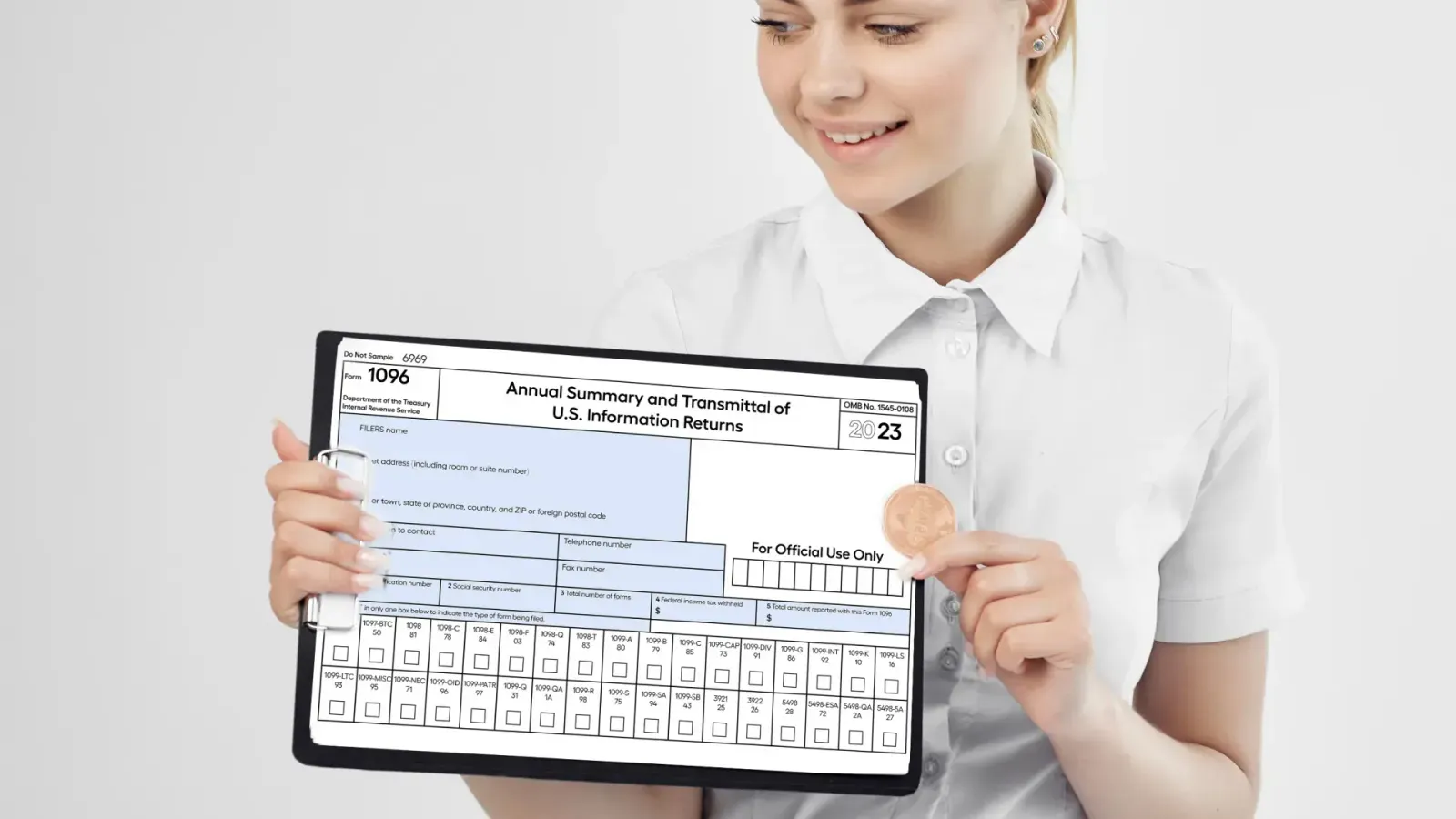

Source: www.usemultiplier.com

Source: www.usemultiplier.com

Understanding and Filing Form 1096 Multiplier, However, sole proprietors who do not have an ein must enter their ssn in box 2. Form 1096, or the annual summary and transmittal of u.s.

Source: www.discounttaxforms.com

Source: www.discounttaxforms.com

1096 Transmittal Forms Carbonless Continuous Discount Tax Forms, Form 1096, or the annual summary and transmittal of u.s. The organization must use form 1096, annual summary and transmittal of u.s.

Source: www.greatland.com

Source: www.greatland.com

B109605 Form 1096 Transmittal Summary, The 1096 tax form, also known as the annual summary and transmittal of u.s. Form 1096, or the annual summary and transmittal of u.s.

Irs Form 1096 Is Required As A.

Information returns, is a document used to summarize and transmit various information.

However, Sole Proprietors Who Do Not Have An Ein Must Enter Their Ssn In Box 2.

Form 1096 is used when you’re submitting paper 1099 forms to the irs.

Posted in 2025